tax credit survey ey

About the survey. Our team has 60 years of combined domain knowledge and development of industry best practices for maximum tax credit generation.

Ey Attractiveness Survey Romania 2021

Ey Survey For 12th Annual Domestic Tax Conference Ranked Flat Taxes First And Vat Second As Ideal Tax Regime Provides An Easy To Understand Explanation Of How Bitcoin Works As A Payments System Including The Anatomy Of A Bitcoi Virtual Currency Cryptocurrency Bitcoin A Simple Guide To The R D Tax Credit Bench Accounting.

. Posted by 1 year ago. RD Tax Credit guidelines in July 2020 1. Multiple megatrends are disrupting the very nature of global corporate tax operations.

Let me ask you I promise not to do anything bad with your SS want to post it on CD we know the answer already. Theyre asking for my ssn for a tax credit survey. NEW YORK April 26 2017 PRNewswire -- No credits no deductions and a flat income tax rate describes the ideal tax regime ranked first by corporate tax professionals according to EYs yearly.

The tax survey is complete. Click Finish to receive final instructions. Becaue the questions asked on that survey are very private and frankly offensive.

We invite you to leverage our experience knowledge and business insights to help you succeed. Yet they are attempting this even as they face challenges retaining and. The pace of regulatory change and the digitalization of tax authorities demands for transparency technological advances and the explosion of data are just a few of the forces.

53 of tax leaders expect greater enforcement in the next three years especially as governments begin to. For 2019 the survey results show degrees of change and transparency already at high levels are accelerating almost. Take WOTC survey.

The website on the search bar is wotcgsey. Click Take Survey to answer the questions and follow the prompts until. Message about your eligibility displays.

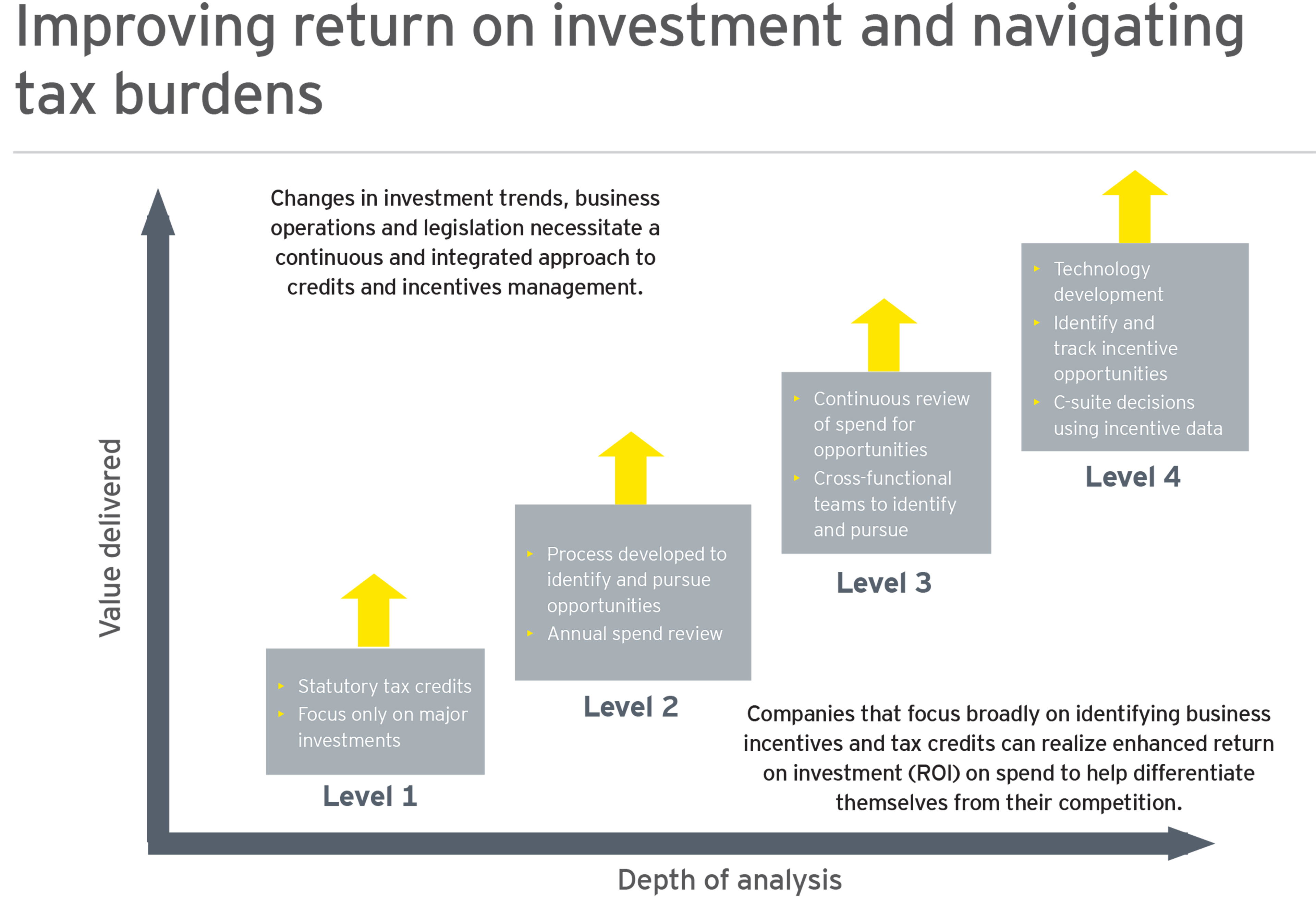

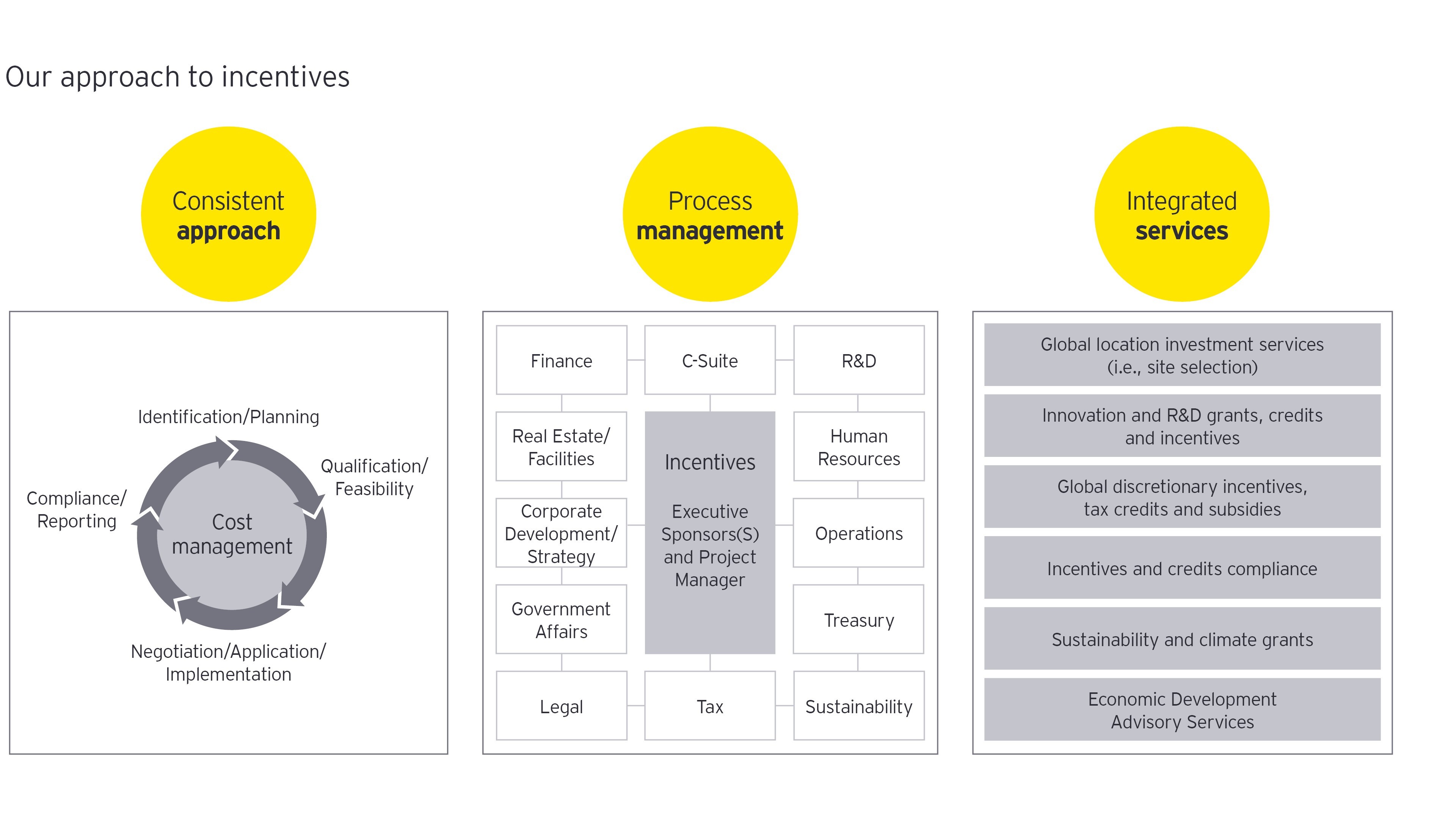

The Worldwide RD Incentives Reference Guide offers taxpayers the information necessary to identify and assist to leverage opportunities to benefit from available incentives especially relevant if they are contemplating new or expanded investments in RD innovation and sustainability. Upload any documents needed to complete this task. We invite you to discuss the results and insights of the 2020 Tax and Finance Operate Survey.

In another survey that polled 150 senior tax executives at companies with revenues ranging from 100 million to 3 billion from November through December 2020 43 of respondents plan to outsource. Our tax professionals can also provide help with identifying solutions for tax related services associated with people compliance reporting and law. For 2019 this includes over 700 responses from senior tax and transfer pricing executives representing the Americas Europe and Asia-Pacific.

Many businesses of all sizes but especially the very largest have not fully adjusted to ongoing dramatic changes in tax authority scrutiny of their affairs according to respondents to EYs 2021 Tax Risk and Controversy SurveyAnd change may be far from over. By screening hiring and retaining WOTC qualified employees your business may receive a federal tax credit ranging from 1500 to 9600 per qualified individual based on the certified target group. Employers must apply for and receive a.

Theyre asking for my ssn for a tax credit survey. These were measures for which various bodies and interested parties had been calling for over the last few years and. You may need to download and electronically sign forms as part of this task.

Interviewed 1265 tax and finance leaders across 60 jurisdictions and 20 industry sectors during the fourth quarter of 2020. Understandably the Form 941 reporting process is complex and includes a new Worksheet 1. Employers may meet their business needs and claim a tax credit if they hire an individual who is in a WOTC targeted group.

Theyre asking for my ssn for a tax credit survey. Im filling out an online job application chilis. Join us for a discussion around the current Work Opportunity Tax Credit WOTC legislative environment and hear from our Ernst Young LLP professionals on how your business can continue to effectively leverage this program and benefit from a recent Joint Directive to IRS examiners.

Among the attendees at the EY 36 th Annual International Tax Conference the 355 survey respondents represent senior. EY is a global leader in. Two senior IRS officials will be on hand to discuss the Joint.

Big companies want the tax credit and it might be a determining factor in selecting one applicant over another. The website on the search bar is wotcgsey. Take the survey answering questions as needed.

Past surveys have identified key trends and their associated risks and opportunities. EY has competencies in business tax international tax as well as transactional tax. EY brings the multifunctional tax technical capabilities and experience of our Employment Tax Tax Credits and Compensation Benefits practices to assist our clients during this unique time.

EY refers to the global organization and may refer to one or more of the member firms of Ernst Young. Lorem Ipsum is simply dummy text of the printing and typesetting industry. When you finish the survey the system checks whether the employer can receive tax credits.

The content of our guide remains structured in a. Among the attendees at the EY 36 th Annual International Tax Conference the 355 survey respondents represent senior. Tax credit survey ey.

EY is at the forefront of the ERC - Our National Tax office has been working closely with the Government agencies to fully understand and assist employers with the. EYs 2020 Global Tax Technology and Transformation Survey highlights. The 2022 EY Tax and Finance Operations Survey TFO survey which queried 1650 executives in more than 40 jurisdictions and a dozen industries has found that organizations are having to find a balance between driving value managing risk and reducing cost.

Replacing the version published in June 2019. Finance Act 2019 introduced changes to the RD tax credit regime that predominantly focuses on small and micro companies. Are employers participating in the employee Social Security tax deferral program.

As we previously reported EY Tax Alert 2020-1199 the IRS has now released a draft Form 941 and instructions that starting with the 2020 second quarter provide the details necessary for claiming the federal COVID-19 tax credits including the employee retention credit. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment. On August 28 2020 the IRS in Notice 2020-65 responded to a Presidential Memorandum executive order by giving employers the option 1 to delay their withholding of the 62 employee share of Social Security and the comparable Railroad Retirement tax for certain.

Complete WOTC survey process record confirmation number and print forms if applicable Upon completion of the survey a Survey Complete page will appear.

Global Location Investment Credit And Incentives Services Ey Us

Ey Study More Than Half Of Employees Globally Would Quit Their Jobs If Not Provided Post Pandemic Flexibility

Ey Survey For 12th Annual Domestic Tax Conference Ranked Flat Taxes First And Vat Second As Ideal Tax Regime

Ey Workforce Services Helping You Build And Benefit From A Diverse And Qualified Workforce 2 October Ppt Download

Ey Workforce Services Helping You Build And Benefit From A Diverse And Qualified Workforce 2 October Ppt Download

74 Companies Plan To Divest Non Core Assets In 24 Months Ey India Survey Business Standard News

Ey Workforce Services Helping You Build And Benefit From A Diverse And Qualified Workforce 2 October Ppt Download

Ey Workforce Services Helping You Build And Benefit From A Diverse And Qualified Workforce 2 October Ppt Download

How Electronic Payments Can Bridge The Tax Gap Global Government Forum

Big Four Consulting Projects Cost More Than Expected Accounting Today

Ey Workforce Services Helping You Build And Benefit From A Diverse And Qualified Workforce 2 October Ppt Download

How Tax Is Influencing The Design Of Sustainable Supply Chains

How Can Banks Transform For A New Generation Of Customers Ey Netherlands

Global Incentives Innovation And Location Services Giils Ey Malaysia

Ey Survey For 12th Annual Domestic Tax Conference Ranked Flat Taxes First And Vat Second As Ideal Tax Regime

General Survey Job Application Surveys How To Apply